Artificial Intelligence as a Service

Take The Risk Out Of Your Risk-Management Process

Analyse images and video data with Artificial Intelligence to unlock efficiencies and competitive advantage.

Impact in days or weeks. Not months.

MaxusAI: Your Future-Proof Insurance & Finance Solution

MaxusAI helps finance organisations of all sizes automate their image and video analysis to identify potential risks, create more user-friendly digital experiences and reduce ongoing operational costs.

The age-old problem of natural disasters, coupled with the 21st Century rise of the digital native generation and fintech start-ups, have redefined what customers expect from financial institutions. These changing demands have made real-time decisions more crucial- and costly- for the insurance and finance sectors alike. But A.I provides the solution-

Through machine learning and computer vision, we help you avoid the hazards of established rules by learning through example. An insurance company that can take policyholder-uploaded photos from an accident in real time and instantly respond with a repair estimate is an insurer that sees lower claims costs, creates a stress-free experience and can more accurately underwrite risk. In short? They’re an insurer who is 21st Century ready.

Here’s what the data already shows us about the effects of adopting A.I for the insurance sector:

* According to McKinsey reports, A.I can generate $1.1trillion in additional value for the insurance industry.

* Switching to A.I from the traditional, paper-based claims management process can save up to 80% of premiums revenues.

* Firms who’ve adapted A.I technology to identify insurance fraud have saved $6 million and seen ROI increase by over 200% in a single year as a result.

A.I is the way for any insurance & finance firm to get the leading edge and deliver unbeatable value to their customers.

Talk to a member of our expert team today

Benefits Of Implementing MaxusAI:

Streamlined Claims

Otherwise tedious and time-consuming visual inspections for damage like breaks or scratches are automated instead. This means that accurate claims estimates can be made in real time, increasing customer satisfaction.

Remote-First

Visually confirm customer/ user identity for remote-first digital on-boarding.

Increased Accuracy

This means improved visual assessment and distinction of objects of interest such as vehicle body panels, rooftop type, manufacture of tiles, insulation etc. The surface area damaged and instances of damage can also be accurately identified, while risks in images and video helps you to underwrite claims and calculate insurance premiums more accurately.

Digital Compliance

Manage compliance digitally and globally, with human-in-the-loop support ensuring (and controlling) a high level quality of data in production.

Discover Insights

A.I predictions can be integrated into your logs, reports and dashboards.

See MaxusAI in Action

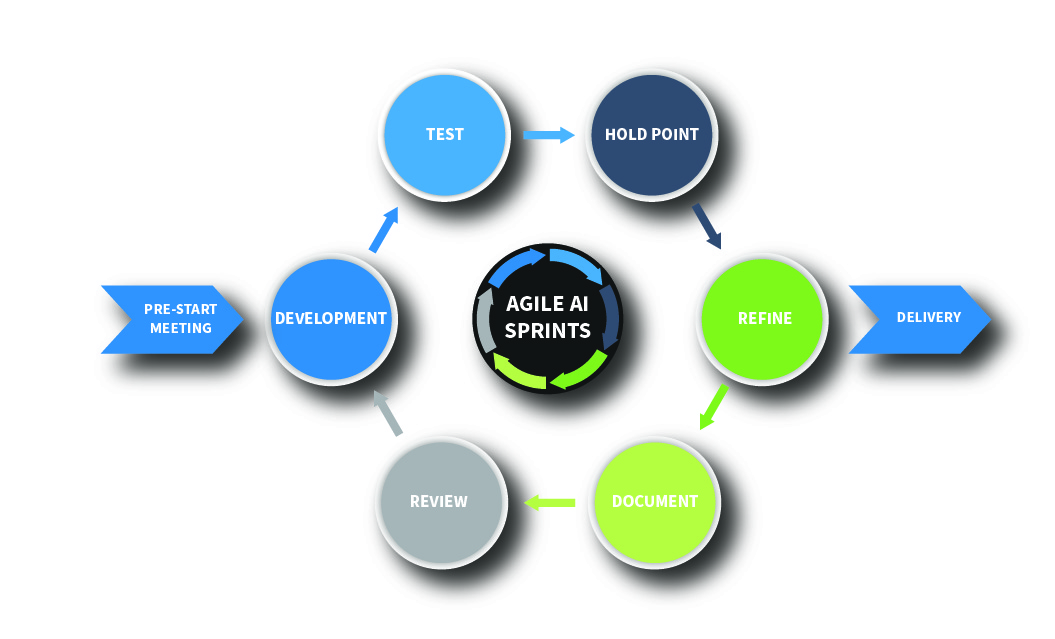

Experience endless possibilities and drive results using agile experimentation. MaxusAI is your end-to-end partner for AI automation.

Let’s discuss solving your problems and book in a no-obligation demonstration.